In a shift of stance towards the property sector, HLIB Research has downgraded its rating from ‘Overweight’ to ‘Neutral’ despite its notable performance throughout the year, citing concerns about sustainability moving forward.

According to the released note today (Dec 7), HLIB Research highlighted the sector’s robust performance, which showcased improvements in year-to-date earnings (+5.1% YoY), sales (+21.4% YoY), and launches (+1.17x YoY).

The research firm attributed the earnings surge to accelerated billings recognition, driven by an improved labor market and increased sales. Yet, it anticipates a moderation in billings and a more restrained growth trajectory for sales and launches in the upcoming months.

“The sector’s advancement this year was predominantly fueled by the supply side,” HLIB Research pointed out. It emphasized that developers experienced a surge in earnings due to accelerated construction progress, a trend that is expected to normalize in 2024.

The rise in sales, it added, was partly attributed to customers shifting from secondary to primary markets in response to increased availability of new products.

HLIB Research expressed skepticism about a notable change in property demand, highlighting the moderate growth of the domestic economy this year (HLIBf: +3.8%). It anticipates continued moderate growth in 2024, projecting a 4-5% GDP growth based on BNM’s estimate (HLIBf: +4.8%).

Consequently, the firm predicts a reluctance among developers to significantly increase launches in 2024, considering the market’s readiness to absorb a higher volume.

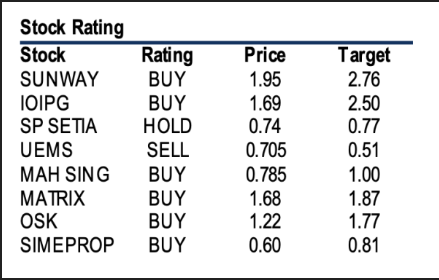

However, HLIB Research identified specific entities, such as Sunway Bhd, OSK Holdings Bhd, IOI Properties Group Bhd, and Sime Darby Property Bhd, as potential outperformers within the sector and market.

The revision in rating comes as a precautionary measure, reflecting the cautionary outlook regarding the sustainability of the property sector’s performance amid changing market dynamics.