Chinese fast fashion giant Temu has emerged as the dominant force in the Japanese and South Korean app markets, surpassing its competitor Shein following a successful expansion into Western markets.

Goldman Sachs, in an Oct. 4 report, stated, “Temu has rapidly expanded its footprint beyond the U.S. and into a number of international geographies and we believe it is now available in 40+ countries … where we continue to see opportunities for growth in the quarters ahead.”

The investment firm estimates that Temu, owned by PDD Holdings, now generates more than $1 billion of monthly transaction value and anticipates continued growth into the second half of 2023.

In contrast, media reports suggest that its rival, Shein, was on track to hit $30 billion in transaction value in 2022.

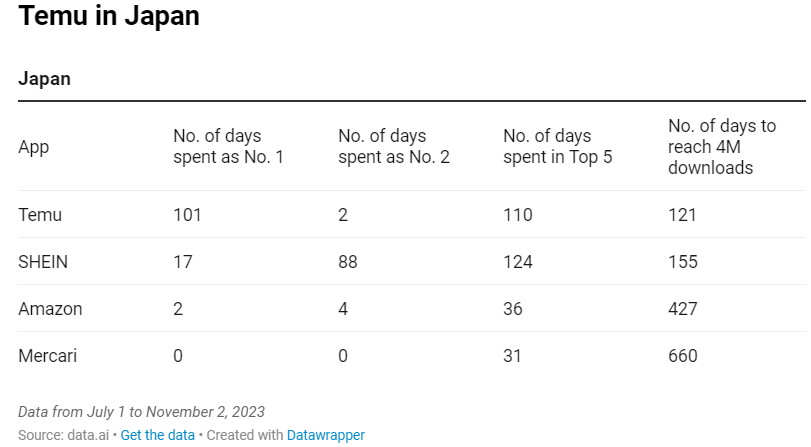

Temu’s success in Japan and South Korea is evident in its prolonged dominance of shopping app rankings in those regions, surpassing Shein. According to data.ai analysis shared with CNBC, Temu maintained the top position in daily iOS & Google Play shopping app downloads in Japan for 101 out of 124 days since its July launch, whereas Shein only led for 17 days in the same period.

Temu achieved four million downloads in Japan in approximately 121 days, outpacing Shein’s 155 days, Japanese marketplace Mercari’s 427 days, and Amazon’s 660 days.

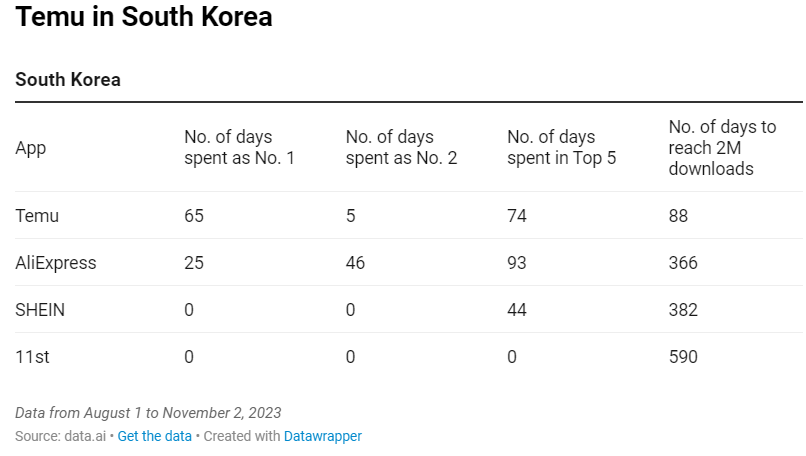

Similarly, in South Korea, Temu topped daily iOS and Google Play shopping app downloads for 65 out of 93 days from Aug. 1 to Nov. 2, surpassing Alibaba’s AliExpress (25 days), while Shein ranked among the top 5. Temu was the fastest to reach 2 million downloads in South Korea at around 88 days, while Shein took 382 days and AliExpress took 366 days to achieve the same milestone.

The rivalry between Temu and Shein extends beyond e-commerce to the courtroom. However, recent documents indicate that both parties have applied to end their lawsuits against each other.

Launched in the U.S. in September 2022, Temu, backed by PDD Holdings, quickly gained popularity among budget-conscious consumers and expanded globally. Its rise has been attributed to marketing investments, low prices, and successful referral campaigns, according to analysts.

Citi analysts noted, “We believe the main reason for [PDD’s] 131% year-on-year growth in transaction service revenues and 135% year-on-year growth in cost of goods sold in the second quarter of 2023 was related to the fast ramp of Temu performance.”

Temu’s success is expected to contribute significantly to non-U.S. transaction value and overall growth, with analysts anticipating an increase in active users and order volume.

In June, the U.S. House Select Committee alleged that both Shein and Temu violated import tariff laws by importing goods into the U.S. without paying import duties or undergoing human rights reviews.